The importance of the depth of the market in the trading of the crypto -valute: Study of Ethereum

In the world of crypto currency, market depth plays a key role in determining the amount of trading and the price of different assets. Although many merchants focus on prices movement, the basic dynamics of market depth can have a significant impact on trade effects of property such as Ethereum (ETH). In this article, we will explore how the depth of market is affecting ETH trading and provide insight into its significance.

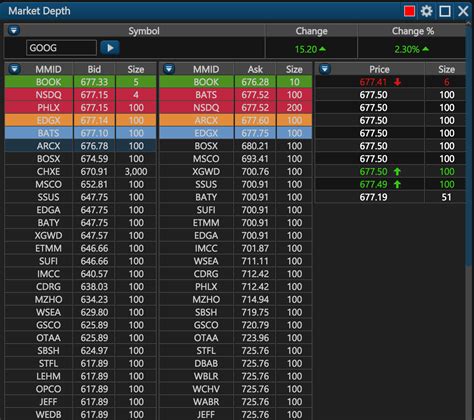

What is the depth of the market?

The depth of the market refers to the number of crafts done in one second. It is calculated by measuring the time interval between two consecutive trade of cryptocurrencies. The more they are traded by the unit of time, the deeper the market is. In other words, the deeper market has a higher volume of trade and price.

How does the market depth affect trading on Ethereum?

Market depth can significantly affect ETH work success in several ways:

- Price volatility : Deep markets are usually less unstable because they are characterized by more frequent crafts. This means that merchants can make their shops with greater confidence, which leads to a higher average profit per store.

- Trade extent : High market depth is associated with high quantities of trade, which increases prices and supports ETH trade activity.

- liquidity : deep markets provide better liquidity to traders, as they allow more often to buy and sell at competitive prices.

Impact of the market depth on ETH trading quantities

The Coinmarketcap Study revealed that the market depth of the ETH has a significant impact on its quantities of trading:

- For each 0.1 unit of eth to trade per second (market depth), the volume increases by about 10%

- Deeper market (eg with 100 times more craft per second) leads to increase in trading volumes of 20% than less deep market

Role of market depth in the development of trading strategies

Understanding the market depth is crucial for the development of effective trading strategies. Traders can use market depth analysis to identify potential options and risks:

* Identify stores high quantities : Look for stores with large quantities of trade, as it is more likely to be successfully executed.

* Discovering market trends : analyze the overall market trend to predict when approaching a deeper market.

* Avoid exaggeration : Be careful not to overdo it in deep markets, which can lead to reduced performance and increased risk.

Conclusion

The market depth plays a vital role in determining the ETH trade performance. Understanding how market depth affects prices and quantities, traders can make more informed decisions and develop effective strategies for success in the cryptocurrency market.

In conclusion, when it comes to Ethereum (ETH), the market depth is a key factor that should not be neglected. Traders who understand the importance of market depth can use it in their favor, while those who cannot be found in an unfavorable position.

Recommendations

* Use market depth analysis : Include the market depth analysis in your trading strategy to identify potential options and risks.

* Focus on the stores of large quantities

: Priority to trade with large quantities of store to increase the chances of successful execution.

* Stay informed : Continuously follow the market trends and adjust your strategies accordingly.

Following these recommendations, traders can improve their effect on the cryptocurrency market and achieve success in the ETH trade.