Risk management techniques for USDT trade on Coinbase

Cryptoracies have become increasingly popular in recent years and is one of the most sought after trade is USDT (Tether USD). The USDT has a widely accepted acceptance and low taxes to buy and sell cryptocurrencies without high transaction costs. At the same time, as any device class, the USDT trade also deals with risks that need to be alleviated by effective risk management techniques.

Why risk management is crucial for USDT trade

The USDT trade includes many risks including:

* Market Volatility : The USDT value can fluctuate quickly due to market feelings and changes in economic indicators.

* Liquidity Risks : USDT trade can be extremely clear, which makes it difficult to sell devices if necessary.

* The risk of partner

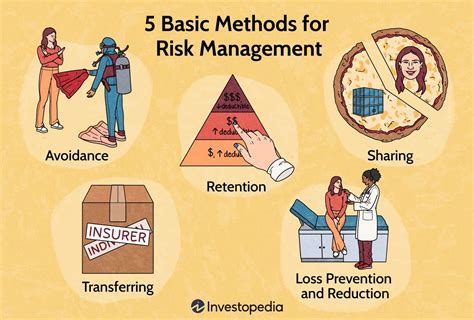

Risk management techniques for USDT trade

In order to alleviate these risks and increase the chances of profitable transactions, merchants should apply the following techniques:

- Position size : Limit the amount invested in each trade to avoid significant losses. This approach is called Stop-Loss Management.

- Stop Stop Commands : Place the Stop Loss commands at a predetermined price level to automatically sell a device when it falls below the threshold, limiting possible losses.

- Risk Return rate : determining the clear risk compensation rate of each trade, ensuring that potential income exceeds potential losses.

- Diversification : Distribution to investments to various cryptocurrencies and assets to minimize the exposure of the market or sector.

- Inforation Strategies : Consider covering techniques, such as using derivative products (such as futures) to manage risk and blocking the potential of profit.

Best exercises for USDT trade on Coinbase

When you are looking for USDT on Coinbase:

* You know the characteristics and fees of the platform.

* Set clear goals and venture tolerance : Define investment goals and be honest because of your risk -taking.

* Developing a Trade Strategy : Developing a systematic approach for transaction management, including positions, stopping loss orders, and risk rewards.

Conclusion

Coinbase USDT requires attention to market volatility, liquidity risks and the risk of the client. By using effective risk management techniques, merchants can reduce their exposure to these hazards and increase the chances of profitable transactions. Remember to always find out about market developments and change your strategy to ensure maximum income.

More sources

* The Risk Management Guide Coinbase : A comprehensive guide to treating the risks of Coinbase cryptocurrency.

* Analysis of the cryptocurrency market

: Sites such as Coindesk, Cryptoslate and Coindesk provide valuable information about the latest market trends and analysis.

* Online Courses and Webinars

: Platforms such as Udemy and Coursera offer courses and webinars on cryptocurrency trade and risk management.