How to analyze the fundamental evaluation of cryptocurrency projects

Cryptocurrencies have drawn special attention in recent years, many investors and businesses seeking to access this space. However, unlike traditional investments such as shares or bonds, cryptocurrencies can be very volatile and require a careful analysis of their fundamental evaluation before investing.

In this article, we will provide a complete guide on how to analyze the fundamental evaluation of cryptocurrency projects, including understanding key measures, identification of red flags and the evaluation of the project growth potential.

Understand the fundamental evaluation

Fundamental evaluation is the process of estimating the intrinsic value of an asset or a project by analyzing its financial performance, its industry trends and other relevant factors. In the context of cryptocurrencies, fundamental evaluation consists in assessing the underlying economic and technical conditions which affect the price of a particular cryptocurrency.

Key measures to analyze

When evaluating the fundamental evaluation for cryptocurrency projects, several key measures must be taken into account:

- Revenue : income is a crucial metric in any business model, and it is essential to understand whether a cryptocurrency project has generated income or not.

- Expenses : Expenses are necessary to support the growth of a project, including wages, marketing and operational costs.

- Margins benefits : The beneficiary margins can give an overview of the efficiency of a project generating feedback.

- Back on investment (King)

: King measures the return on investment for each unit or a dollar invested in a project.

- Capitalization Markets (MC) : MC is an indicator of the confidence of investors and represents the total value of all the actions in circulation of a cryptocurrency project.

- Senture on social networks : The feeling of social media can give an overview of awareness, interest and perception on the market towards a particular cryptocurrency.

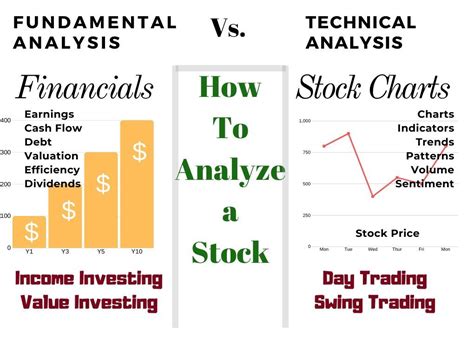

- Technical analysis : Technical analysis consists in analyzing the graphics to identify the models and trends that can indicate potential price movements.

Identification of red flags

Although the fundamental evaluation provides valuable information, it is essential to be aware of the following red flags during the evaluation of cryptocurrency projects:

- Lack of income or profitability

: If a project has not generated income or profitability, this may indicate unsustainable growth.

- High costs : High expenses can lead to financial difficulties and a reduction in investor confidence.

- Team or inadequate management : a lack of experienced members of the team or bad management practices can undermine the success of a project.

- Lack of marketing or promotional activities : insufficient marketing efforts can limit the visibility and adoption of the project.

Assessment of project growth potential

To determine if a cryptocurrency project has growth potential, consider the following factors:

- growth rate : A strong growth rate indicates that the project is experiencing increased demand.

- Competitive advantage : a single competitive advantage can differentiate a project from its competitors and increase adoption.

- Industry trends : Understanding industry trends and market changes can help assess whether the value of a project lies in its wider niche or market.

- Adoption rate : an increasing adoption rate indicates that the project is gaining ground.

Tools for fundamental evaluation

To analyze the fundamental evaluation of cryptocurrency projects, several tools can be used:

- Coingecko : Coingecko provides data on cryptocurrencies, negotiation volumes and market capitalization.

- Coinmarketcap : CoinmarketCap offers complete data on cryptocurrency projects, including income, expenses and return on investment.

3 and 3